Do you remember those scenes in old Western movies in which a stagecoach raced across the American plain?

While we are grateful for the modern system of interstate highways, the stagecoach's image is nevertheless one of romance, energy, and alignment. All that beauty and speed captured in all those animals -- and they were all headed in the same direction at the same time.

You may consider me a slow learner, but I

only recently discovered that the horsepower advertised in today's cars is based on a formula derived from . . . you guessed it . . . horse power.

And there are times when churches have horsepower as well.

Times when churches harness all their energy and all their muscle and head in the same direction with intentionality and alignment.

For some churches, it happens during a capital campaign.

For others it's during a

Fifty Day Spiritual Adventure.

For still others it's during an emphasis like

Forty Days Of Purpose,

Forty Days Of Prayer, or

Forty Days of Love.

At Good Shepherd, we often call these special seasons our

Radical Impact Projects which you can read about

here and

here.

How does such programming happen and such horsepower emerge from within the life of a church?

This: when sermons, small groups, students, and children are all digging into the same Scripture and the same subject matter. In lessons and activities developed on an age appropriate basis, whole congregations become propulsive with power when all their sub-groupings are headed in the same direction at the same time.

One of the earliest times we "caught" this truth was on our first ever "Grace" Sunday in 2012. We offered a grace-based salvation message at all three worship gatherings, in our student ministries, and in our children's ministry settings. The results were truly breathtaking, as over 100 people across all environments made saving decisions for Jesus Christ.

Community Christian Church in suburban Chicago has summarized its approach in

The Big Idea.

While Good Shepherd gives more latitude to its LifeGroup and family ministries most of the year, there is a level of unparalleled excitement when we harness all our horses to head precisely in the same direction. That's one of the reasons our current

Preventology series has the buzz that it does: the entire congregation is reading the same Scripture each day (in this case, a chapter from Proverbs per day) and praying the same prayers. That focused devotion and harnessed energy is vital to increasing a church's horsepower.

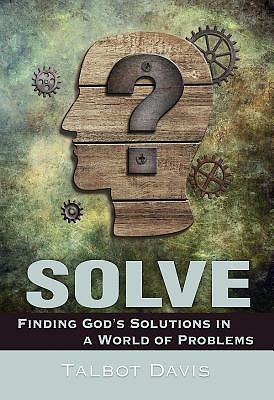

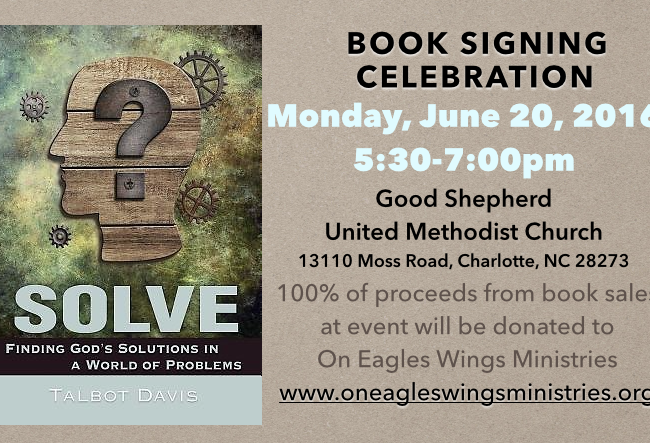

All that is why I'm so excited about

Solve, recently released by Abingdon Press. We were able to turn a sermon series on Nehemiah into much more than a series of sermons. It instead became a Radical Impact Project in which people

moved on what they were

moved by, and fed the city of Charlotte with a record-setting outpouring of food.

I believe

Solve can be an ideal church-wide project in the months to come. You can order your copies

here.

And then watch as all the horsepower of your church gets directed not to pointing out problems but to pinpointing solutions.

Sign up for my sermon tips newsletter and get additional sermon tips, information, and updates.

Then, OJ. You know, before:

Then, OJ. You know, before:

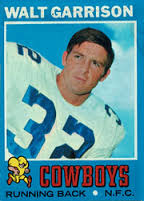

My favorite football 32 was not so well known . . . unless you grew up in Dallas and loved the Cowboys:

My favorite football 32 was not so well known . . . unless you grew up in Dallas and loved the Cowboys:

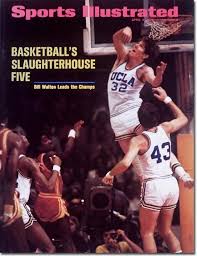

In basketball, there was Bill Walton:

In basketball, there was Bill Walton:

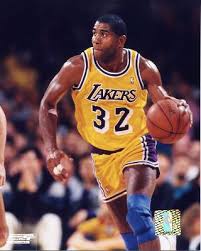

And who could forget Magic in gold?

And who could forget Magic in gold?

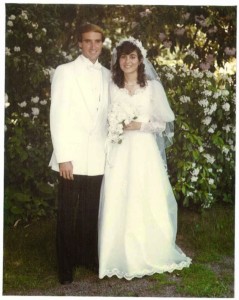

And here's another 32. Not so famous, I suppose, but it's a number that means something to us on June 9, 2016.

And here's another 32. Not so famous, I suppose, but it's a number that means something to us on June 9, 2016.